In today’s financial world, credit scores are crucial tools used by financial institutions to evaluate the creditworthiness of individuals or businesses. Credit scores help assess the risk associated with lending and streamline the decision-making process. This article will explain why we need credit scores, how they are calculated, and the importance of understanding your credit score.

What is a Credit Score?

A credit score is a three-digit number that reflects a person’s creditworthiness. This number is based on an analysis of an individual’s credit history, which includes various factors such as total debt, payment history, length of credit history, types of credit, and new credit inquiries. Credit scores generally range from 300 to 850, with higher scores indicating lower credit risk.

Why is Credit Scoring Important?

- Creditworthiness Assessment: Banks and financial institutions use credit scores to decide whether to grant loans or credit to an individual. A higher credit score increases the chances of approval.

- Lower Interest Rates: Individuals with higher credit scores usually receive lower interest rates, as they are considered to have a lower risk of defaulting on their loans.

- Rental and Mortgage Approvals: Many property owners and mortgage companies check credit scores before approving rental or mortgage applications. A good credit score facilitates the approval process.

- Employment Opportunities: Some employers check credit scores as part of the hiring process, especially for positions involving the management of company finances.

How is a Credit Score Calculated?

Credit scores are calculated based on several key factors:

- Payment History (35%): Records of whether you pay your bills on time or late.

- Amounts Owed (30%): The total amount of debt you have and your credit utilization ratio.

- Length of Credit History (15%): How long your credit accounts have been open.

- Types of Credit (10%): The variety of credit accounts you have, such as credit cards, mortgages, and personal loans.

- New Credit (10%): The number of new credit accounts you have opened and the number of recent credit inquiries.

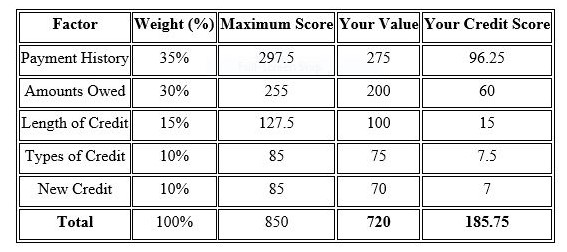

Example of Credit Score Calculation

Below is a sample example calculation using the factors mentioned above:

In this example, your credit score is 185.75 out of a maximum of 850. This is a simplified illustration, and the algorithms used by credit rating agencies can be much more complex.

Tips to Improve Your Credit Score

- Pay Bills on Time: Timely payments have a significant impact on your credit score.

- Reduce Debt: Try not to use more than 30% of your credit limit.

- Avoid Opening New Credit Accounts Frequently: Too many credit applications in a short period can lower your score.

- Maintain Long-Term Credit Accounts: A long credit history demonstrates stability.

How Financial Inclusion can help and support a great cause

Financial inclusion is a critical driver of economic development and a pivotal factor in reducing poverty and inequality. By ensuring that everyone has access to affordable financial services, Government can empower individuals and communities, fostering overall economic growth. This blog will delve into the importance of financial inclusion, how it supports great causes, and provide an illustrative example with a financial calculation to demonstrate its impact.

What is Financial Inclusion?

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit, and insurance – delivered in a responsible and sustainable way.

How Financial Inclusion Supports a Great Cause

1. Empowerment of Individuals and Communities

- Access to financial services allows people to save money securely, invest in education, and manage risks.

- Microfinance and microloans enable small entrepreneurs to start or expand their businesses, creating jobs and improving livelihoods.

2. Economic Growth

- Inclusive financial systems help increase GDP by tapping into the economic potential of all citizens.

- Financial inclusion fosters economic stability by broadening the financial base and increasing the availability of capital.

3. Reduction of Poverty and Inequality

- With financial services, lower-income individuals can escape the poverty trap by building assets and investing in their futures.

- It reduces inequality by providing equal opportunities for financial growth and stability.

4. Social Development

- Financial inclusion contributes to improved education and health outcomes as families can afford better services.

- It encourages the development of a savings culture, leading to more secure and predictable financial futures for all.

Financial Inclusion: A Case Study

To illustrate the impact of financial inclusion, let’s consider a simple example involving microloans.

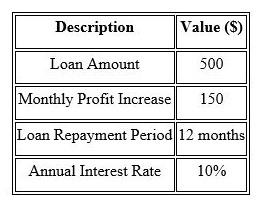

Scenario:

- A microfinance institution offers loans of $500 to small business owners.

- The average monthly profit increase for these businesses due to the loan is $150.

- The loan repayment period is 12 months with an interest rate of 10% annually.

Let’s calculate the total profit increase for a business over the loan period and the net benefit after repaying the loan.

Calculation:

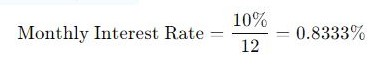

Monthly Interest Rate Calculation:

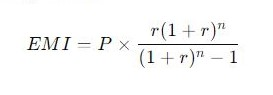

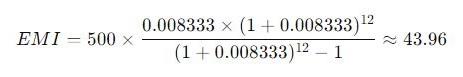

Monthly Repayment Amount Using EMI Formula:

- P is the loan amount ($500)

- r is the monthly interest rate (0.008333)

- n is the number of months (12)

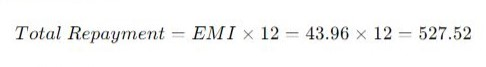

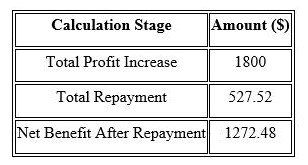

Total Repayment Over 12 Months:

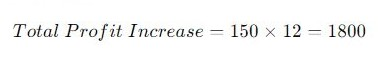

Total Profit Increase Over 12 Months:

Net Benefit After Loan Repayment:

Net Benefit = Total Profit Increase – Total Repayment = 1800 – 527.52 = 1272

The Challenge of Bringing Unbanked People into the Banking System and How Credit Scoring Can Help

Despite the advancements in the financial sector, a significant portion of the world’s population remains unbanked, meaning they do not have access to traditional banking services. This blog explores the challenges of bringing unbanked people into the banking system and how credit scoring can play a crucial role in this endeavor. We’ll also provide a financial calculation to illustrate the potential benefits.

The Challenge of Financial Inclusion

1. Lack of Documentation: Many unbanked individuals lack the necessary identification documents required to open a bank account. This barrier is particularly prevalent in rural and underserved communities.

2. Limited Financial Literacy: Understanding financial products and services is a significant hurdle. Without basic financial literacy, people are less likely to engage with formal banking institutions.

3. Physical Barriers: In remote areas, access to physical bank branches is limited. The cost and time associated with traveling to a bank can be prohibitive for many.

4. Trust Issues: A lack of trust in financial institutions can deter people from opening bank accounts. This distrust may stem from previous negative experiences or a general skepticism of formal financial systems.

5. Cost of Services: High fees associated with banking services can be a deterrent for low-income individuals. If the cost of maintaining a bank account outweighs its benefits, people are less likely to participate.

How Credit Scoring Can Help

Credit scoring can significantly enhance financial inclusion by providing a means to assess the creditworthiness of individuals who lack traditional credit histories. Here’s how:

1. Alternative Data Sources: Modern credit scoring models use alternative data sources such as utility payments, mobile phone usage, and rental payments to evaluate creditworthiness. This approach benefits individuals who don’t have traditional credit records.

2. Encouraging Responsible Borrowing: With access to credit scoring, individuals can be incentivized to maintain good financial habits, such as timely bill payments, which in turn improve their credit scores and access to credit.

3. Reducing Risk for Lenders: Credit scores help financial institutions assess the risk of lending to individuals without traditional credit histories, enabling them to extend credit more confidently and at lower costs.

4. Personalized Financial Products: Financial institutions can tailor products to the needs of individuals based on their credit scores, offering better interest rates and terms to those with higher scores.

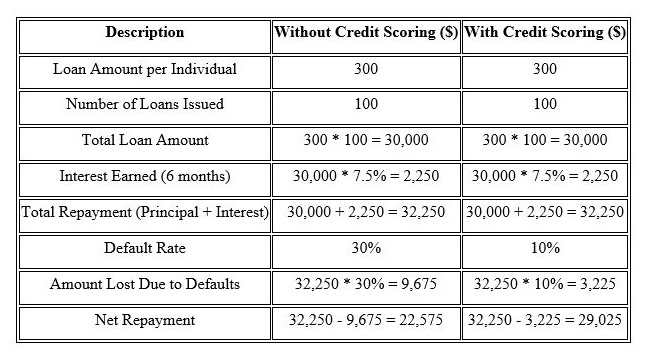

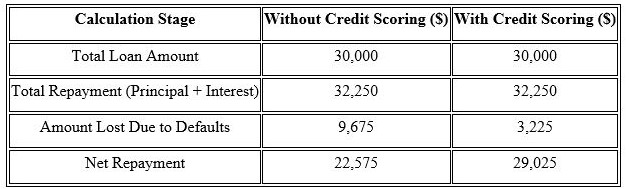

Financial Calculation: The Impact of Credit Scoring

To illustrate the potential benefits of credit scoring, let’s consider a scenario where a microfinance institution uses alternative credit scoring to provide loans to unbanked individuals.

Scenario:

- A microfinance institution offers loans of $300 to unbanked individuals.

- The interest rate is 15% annually.

- The repayment period is 6 months.

- Without credit scoring, the default rate is 30%.

- With credit scoring, the default rate drops to 10%.

Let’s calculate the financial impact using these assumptions.

Calculation:

Conclusion :

Understanding the importance of credit scoring and financial inclusion is essential for anyone looking to improve their financial health and participate fully in the economy. Here’s a breakdown of why these concepts matter and how they work:

The Importance of Credit Scores

- Creditworthiness Assessment: Credit scores help banks and financial institutions evaluate the likelihood that an individual will repay a loan. Higher scores suggest lower risk, increasing the chances of loan approval.

- Lower Interest Rates: Individuals with higher credit scores typically receive loans at lower interest rates, saving money over time.

- Rental and Mortgage Approvals: A good credit score can ease the process of getting approved for renting a home or securing a mortgage.

- Employment Opportunities: Some employers review credit scores, particularly for roles involving financial responsibility.

How Credit Scores Are Calculated

Credit scores are derived from several factors:

- Payment History (35%): Timeliness of bill payments.

- Amounts Owed (30%): Total debt and credit utilization ratio.

- Length of Credit History (15%): Duration of credit accounts.

- Types of Credit (10%): Diversity of credit accounts.

- New Credit (10%): Number of new accounts and recent inquiries.

By maintaining good financial habits, such as paying bills on time and managing debt wisely, individuals can improve their credit scores.

Tips to Improve Your Credit Score

- Pay Bills on Time: Consistently paying bills when due has a significant impact.

- Reduce Debt: Keep credit card balances low.

- Avoid Frequent New Credit Applications: Multiple credit inquiries in a short period can lower your score.

- Maintain Long-Term Credit Accounts: A lengthy credit history demonstrates reliability.

The Role of Financial Inclusion

Financial inclusion ensures that everyone has access to essential financial services such as banking, loans, and insurance. This inclusivity supports several positive outcomes:

- Empowerment of Individuals and Communities: Access to financial services helps people save securely, invest in education, and manage risks. Microloans can support small businesses, creating jobs and improving livelihoods.

- Economic Growth: Inclusive financial systems can boost GDP by enabling more people to participate economically.

- Reduction of Poverty and Inequality: Financial services help individuals build assets and invest in their future, providing equal opportunities for financial growth.

- Social Development: Financial inclusion contributes to better education and health outcomes and promotes a culture of saving.

Overcoming Challenges to Financial Inclusion

Many barriers prevent people from accessing financial services:

- Lack of Documentation: Many unbanked individuals lack the necessary identification to open bank accounts.

- Limited Financial Literacy: Without understanding financial products, people are less likely to engage with banking institutions.

- Physical Barriers: Remote areas often lack access to bank branches.

- Trust Issues: Distrust in financial institutions can deter people from opening accounts.

- Cost of Services: High fees can be a significant deterrent for low-income individuals.

How Credit Scoring Can Help

Credit scoring can support financial inclusion by:

- Using Alternative Data: Modern credit scoring can evaluate creditworthiness using utility payments, mobile phone usage, and rental payments.

- Encouraging Responsible Borrowing: Access to credit scoring can motivate individuals to maintain good financial habits.

- Reducing Risk for Lenders: Credit scores allow financial institutions to extend credit with more confidence, potentially at lower costs.

- Personalized Financial Products: Institutions can tailor their products to individual needs based on credit scores.

Financial Inclusion: A Case Study

Consider a microfinance institution that uses credit scoring to provide loans to unbanked individuals. By assessing credit risk more accurately, the institution can reduce default rates and extend credit more effectively, leading to better financial outcomes for borrowers and lenders alike.

For example, a microfinance institution offers $300 loans with a 15% annual interest rate over six months. Without credit scoring, the default rate is 30%, but with credit scoring, it drops to 10%. This reduction in defaults leads to higher net repayment, illustrating the financial benefits of credit scoring in promoting financial inclusion.

By understanding and leveraging credit scores and financial inclusion, individuals and institutions can foster a more inclusive and prosperous financial environment.